Preventing Identity Theft

By: The Security Awareness Company

Imagine receiving an invoice for a service you didn’t subscribe to or discovering inquiries on your credit report that you didn’t authorize. Both scenarios could indicate that someone has used your personal information to commit a fraud, known as identity theft.

Here are just a few examples of what someone could do if they managed to steal your identity.

- Apply for a loan by using your credit score

- Open credit cards in your name

- Take over your online accounts

These scenarios are common worldwide and highlight a key point about this kind of cybercrime: It’s personal and can have lasting effects. That’s why it’s important to understand the impacts of data breaches.

Full names, home addresses, national identification numbers, and other forms of data, when combined, give criminals what they need to commit fraud. Ensuring that information is never leaked or stolen helps protect the wellbeing of real people.

You can do your part by staying alert for scams and using extreme caution when handling confidential information. Attackers sometimes attempt to impersonate people you know, like a manager or coworker. So, never assume someone is who they claim to be and report anything suspicious immediately.

Other Types of Identity Theft

Synthetic Identity Theft: A synthetic identity is completely or partially fabricated. Commonly, a legitimate national identification number is used in combination with a fake name, address, phone number, and birthdate to create a fake person.

Child Identity Theft: This scam targets children by using their information to open a new account or line of credit. What makes child identity theft especially unfortunate is that it is often carried out by a family member, and most victims don’t realize they’ve been scammed until they’re much older.

Business Identity Theft: Also known as corporate or commercial identity theft, this scam occurs when someone poses as an owner, executive, or employee of an organization. The goal is to leverage that organization’s credit or reputation for financial gain.

Related Articles

Financial Literacy Important to Wellbeing

April is Financial Literacy Month. At Pittsford Federal Credit Union, we remain passionate about financial literacy and education. ...

New Scam Alerts

Unfortunately, scams and fraudulent activity are still on the rise. We want to make members aware of some of the scams that we have seen recently at the Credit Union. ...

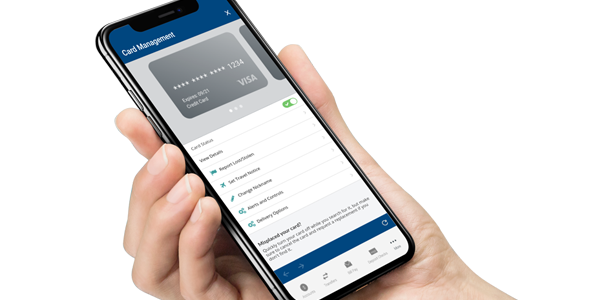

Integrated Card Management, Alerts

We are pleased to introduce our new Card Management & Alerts solution. Enjoy the convenience of managing your PFCU VISA Debit and Credit cards at home or on the go. ...